Post salary calculations, every organization issues a piece of document to its employees at the end of every month, most commonly known as a payslip, salary slip, pay stub, etc. In this article, you’ll learn how to make a salary slip, the important elements of a salary slip format, and download a salary slip format in excel with formula & auto calculations.

What is a salary slip?

A salary slip, payslip, or pay stub is payment advice issued to the employees of an organization once their salaries are credited into their accounts.

A simple salary slip format contains a detailed breakup of the gross and net salary, no. of days worked, no. of hours paid for, tax deductions, paid to the employee. The main components of a salary slip are Basic Pay, House Rent Allowance (HRA), TA, DA, Reimbursements, Medical, Bonus, etc. it also contains the details of statutory tax deductions like PT, PF, TDS, insurance cost, etc.

most companies prefer using a hrm payroll software to generate salary slips and pay stubs. a HR & payroll software makes it easy to calculate, control and generate reports.

if you are looking for an affordable and one of the best payroll software in India, check Zoho.

They have some amazing features. they are cheap and they offer great customer service too.

Apart from the salary structure and deductions, a payslip also contains vital information like the number of days worked in that month, PF account/UAN number, bank account details of the employee, and leave details.

A salary slip also certifies that the employer has paid the salaries for the specified month and the employee has received it.

It’s also treated as income proof by most of the banks. Individuals seeking services like loans, credit cards, and other banking services are asked to submit a minimum of six months’ payslips and bank statements to avail of services.

Most employers use automated payroll software to generate a salary slip format for their employees. It’s easy, fast, and reliable.

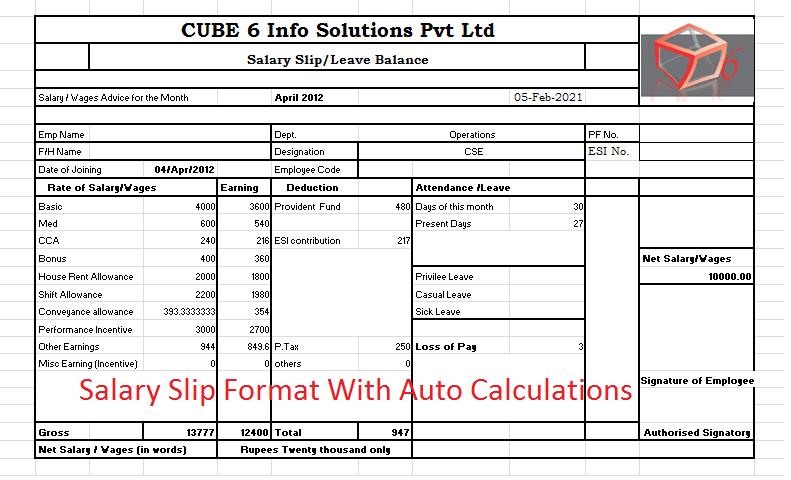

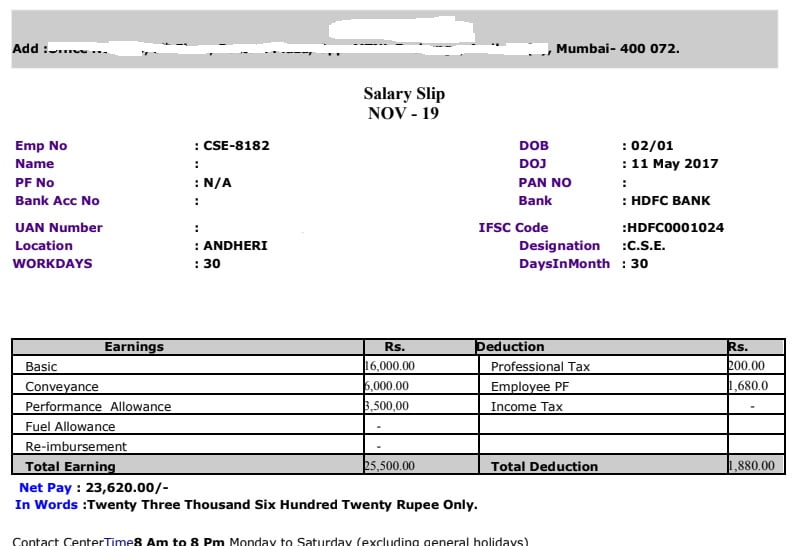

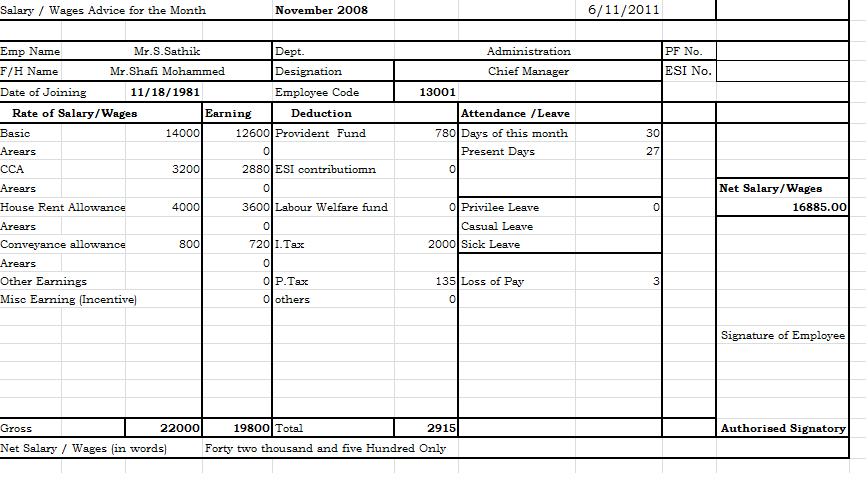

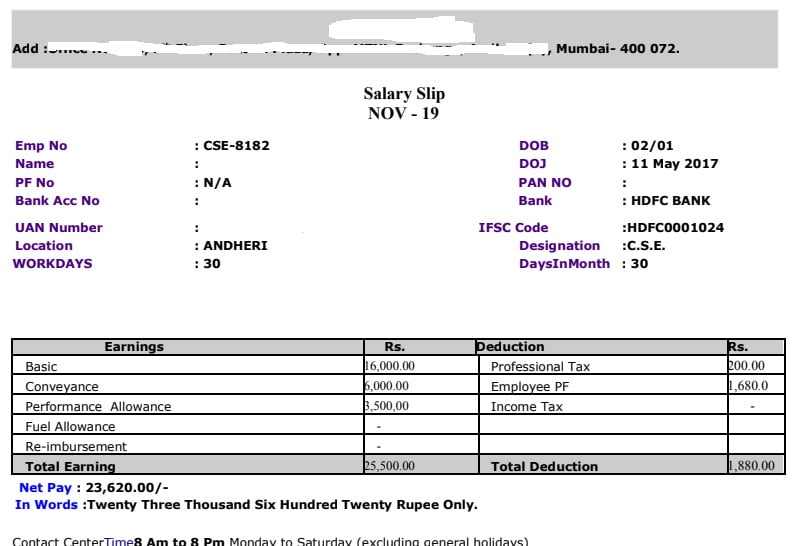

CLICK HERE TO DOWNLOAD SALARY SLIP FORMAT IN EXCEL WITH FORMULA & CALCULATIONS FOR PVT LTD COMPANY

Download Salary Slip Format In Excel With Formula

Send download link to:

How do I make a payslip in excel?

As discussed above, a payslip contains a detailed salary structure and deductions.

A simple salary slip format contains two major headings.

- Earnings

- Deductions

An ideal payslip template in an excel format must include details like

- Organizations name, address, logo, contact details, and registration number

- Month and year the payslip is issued for

- Employee ID

- Employee Pan Card, Adhaar Card, Bank Account details

- EPF Account Number, Universal Account Number (UAN)

- Number of days worked, number of leaves

- Details of payment and deductions

- Gross pay and Net pay

- Sign & Stamp (if not generated by a payroll application)

To make a salary slip in excel format, start with entering details like company name, address, and contact details in the headline section in an excel sheet.

Create another two equal sections in the excel sheet to enter details like employee ID, date of joining, month & year, EPF account number, UAN number, pan card, Aadhaar card, department, number of days worked, number of leaves taken, designation, and department.

The next section of the salary slip in excel format contains two major headings, Earnings & Deductions.

The left-hand side of the section includes earning details like Basic pay, HRA, TA, DA, Medical, special allowances, bonus, mobile, and reimbursements.

The right section of the salary slip format contains deduction details like PF, PT, and TDS.

You may also download our ready salary slip templates in excel formats with formulas.

Enter the basic details and you’ll have a ready to print salary slip in no time. These salary slip format in excel are ideal for small size organizations.

Is it compulsory to issue a salary slip?

Yes, it’s one of the most essential documents for employees and employers. Every working professional/employee needs a salary slip to prove his earnings. It also proves that the employer has made all the dues.

A salary slip is required at the time of income tax calculations and filings. The structure of the salary slip is used for calculating the net payable taxes and refunds.

A salary slip also acts as proof of employment. Companies often demand the last three months’ salary slips along with other documents from the new recruits.

Are salary slips without stamps and signs legally valid?

Yes, only if it’s a payroll software-generated copy. However, manual salary slips must be signed and stamped by a competent authority.

A salary slip/payslip is one of the most forged documents by job seekers. Opting for payroll software can help employers minimize the number of such incidents.

Important components of a salary slip format and their meanings.

- Basic pay: Basic salary is the minimum pay an employee is entitled to receive every month against his/her work for the employer. Every state/country has its own labor law and minimum pay rules for skilled and unskilled sectors. The employers must consider those minimum payment rules before deciding the salaries. The basic pay is calculated at 35% to 50% of the total salary. Basic pay is fully taxable and other major allowances like DA, HRA, and EPF are calculated on the basis of basic salary.

- Dearness Allowance(DA): A certain percentage of the basic salary is paid as DA. DA is paid to compensate for the cost of living and other similar expenses.

- House Rent Allowance (HRA): 40% to 50% on the basic pay is paid as HRA to compensate against the rents payable by the employee.

- Conveyance Allowance (CA): Conveyance allowance is paid to compensate against the traveling cost of the employee from home to work and vice versa.

- Medical Allowance: medical allowance is paid to compensate against the medical expenses of the employee.

- Special Allowances: special allowances are a part of performance-based pay

- Miscellaneous Allowances: all the other allowances paid to an employee fall under the miscellaneous allowance.

- Profession tax: a profession tax is levied on all the working professionals by the Indian government. The employers are supposed to deduct it from the salary and pay the tax.

- EPF: Employee provident fund is a mandatory government scheme. The prime purpose of EPF is to safeguard the interest of the employees in certain situations like unemployment, marriage, illness, and house construction. The employer and employees make an equal contribution to this scheme.

- TDS: The employers are supposed to deduct a certain income tax amount from the employee’s salary and pay it to the government.

FAQ

No. As an Employer, you must issue payslips to your employees on monthly basis.

Yes, You can.

Leave Travel Allowances.

You should not.

No. Handwritten salary slips are not legal.

Please refer our detailed article on salary slip format in excel for the answer.

Yes, if that is how you calculate the compensation.

Payslips are used for determining the annual income of an individual. Often considered as proof of income, banks use them to determine your eligibility for loans, credit cards, and other banking services. Employers use them to check the last drawn salary of the potential employee and decide a fair CTC to be paid.

good